There are lots of totally different journey insurance coverage corporations within the business right now. And with every supplier providing totally different plans, advantages and protection, it could be difficult to determine which one is best for you. That’s why we put collectively this Allianz journey insurance coverage evaluate.

Not solely do you want a dependable firm, but additionally one with sturdy protection and safety in opposition to no matter disaster is thrown your manner.

That’s the place Allianz International Help journey insurance coverage is available in. It’s one of many largest and oldest insurance coverage corporations within the business. And, with a number of plans and advantages to select from, it simply could be the best choice to your journey.

But it surely additionally may not be.

This Allianz journey insurance coverage evaluate will assist making a decision. Alternatively, we’ll assist you determine if one other journey insurance coverage firm may swimsuit you higher.

What Is Journey Insurance coverage?

Earlier than we proceed our Allianz journey insurance coverage evaluate, let’s discuss a bit extra about insurance coverage generally. Journey insurance coverage protects you in opposition to monetary losses that you could be incur whereas touring.

An excellent journey insurance coverage coverage ought to embrace the next classes:

- Journey cancellations, interruptions, and adjustments

- Stolen, misplaced, delayed or broken baggage and property

- (Normally non-pre-existing) medical therapies and bills

It’s necessary to notice that journey insurance coverage is totally different out of your normal medical health insurance plan. For one, medical health insurance often doesn’t cowl you for those who journey to a different nation. And, in contrast to journey insurance coverage, your medical health insurance in all probability doesn’t reimburse for missed flights or misplaced baggage.

In abstract, you must plan to journey with each medical health insurance and journey insurance coverage.

Is Journey Insurance coverage Actually Price It?

Between the price of flights and motels, you could be questioning why you must spend much more cash on journey insurance coverage. In spite of everything, the possibilities of breaking your leg in a scooter accident or getting robbed on the prepare appear slim, proper?

However the reality is: These items can occur to anybody. They usually do.

And in these dire conditions, you’ll be grateful that you’ve got journey insurance coverage by your facet.

The price to guard your self with journey insurance coverage is nothing in comparison with the exorbitant medical payments. And for that reason alone, journey insurance coverage is absolutely price it.

You may by no means have to make use of it. However journey insurance coverage helps you put together for the worst. As I all the time prefer to say, for those who can’t afford journey insurance coverage, you possibly can’t afford to journey!

When to Buy Journey Insurance coverage

You should purchase a journey insurance coverage coverage days, weeks or months earlier than your journey begins.

Nonetheless, the very best time to purchase journey insurance coverage is after you finalize your journey preparations. Journey insurance coverage often turns into efficient the day after you buy the plan. Which means that you’ll be protected with journey cancellation protection. That manner, you’ll be reimbursed in case it’s good to change journey plans earlier than you permit.

It’s additionally necessary to notice that some corporations require that you simply buy a plan upfront. That is for the total protection to take impact.

And with Allianz International Help, buying a plan early has one important profit. Need journey insurance coverage to cowl a pre-existing medical situation? Then it’s beneficial to purchase a plan inside 14 days of creating your first journey cost. By reserving early, you may qualify for a waiver that covers your pre-existing circumstances whereas touring.

So for those who’ve already made journey plans, don’t wait till the final minute. By reserving touring insurance coverage early, you possibly can defend your self in opposition to these pesky journey mishaps!

Who Is Allianz Journey Insurance coverage?

Let’s first begin by introducing you to Allianz International Help. Even for those who’re not conversant in their journey insurance coverage insurance policies, the possibilities are that you simply’ve heard about Allianz generally. Nicely, Allianz International Help is definitely a subsection of Allianz SE. It’s the biggest insurance coverage supplier on the planet right now.

Based over 120 years in the past as a finance firm, Allianz has grown to cowl a variety of companies, together with asset administration and funding methods. However the core of the corporate lies within the insurance coverage enterprise, with Allianz offering protection for property, well being, life and naturally, journey.

However moreover crunching numbers and offering insurance coverage, Allianz goes above and past for native communities world wide. The Allianz Company Giving Program has contributed over $2 million and 16,000 volunteer hours in the direction of applications to assist college students, seniors and dozens of employee-elected charities.

Above all else, journey insurance coverage was created to guard you. However with the Allianz, you possibly can really feel good figuring out that your insurance coverage supplier is there to guard others.

Who Is Allianz International Help Journey Insurance coverage For?

Earlier than we dive into our Allianz journey insurance coverage evaluate, let’s focus on which forms of vacationers would profit from their plans. With 9 totally different plans to select from, Allianz International Help has complete protection for many forms of vacationers.

- Annual Vacationers: With an Allianz annual plan, you may be protected for a whole 12 months, regardless of the place or what number of instances you journey! Annual plans will prevent cash for those who plan to take a couple of or two journeys through the 12 months.

- Senior Vacationers: There isn’t a age restrict for insurance coverage policyholders, which makes Allianz a superb possibility for senior vacationers.

- Households Touring Collectively: With Allianz journey insurance coverage, youngsters beneath 17 can journey with their dad and mom without cost on choose plans. This is a superb and cost-efficient profit for households with one, two, or extra children.

- Enterprise Vacationers: Allianz International Help is without doubt one of the few insurance coverage corporations to supply safety for enterprise tools. We all know it’s annoying to lose or have one thing stolen, particularly if it’s your boss’s!

Who Isn’t Allianz Journey Insurance coverage For?

As a part of this Allianz Journey insurance coverage evaluate, we predict it’s additionally necessary to notice that Allianz isn’t for each sort of traveler. And whereas the excellent plans may work for some folks, it might not match the wants of everybody.

- Journey Vacationers: Allianz doesn’t provide safety for any type of excessive exercise or sport. In case you plan to interact in any thrilling actions, go for World Nomads, which incorporates protection for over 200 totally different excessive sports activities.

- Vacationers Wanting Excessive Medical Protection: We all the time suggest touring with at the very least $100,000 of medical emergency protection. And not one of the Allianz plans provide this quantity of protection. Positive you possibly can’t predict for those who’ll want emergency care when touring. However you must all the time be ready for the worst. In case you come down with a extreme sickness, you could be caught with hundreds of {dollars} in medical payments. World Nomads, however, presents $100,000 in medical emergency protection with each their plans.

What’s Included in Allianz Journey Insurance coverage?

As a part of our Allianz journey insurance coverage evaluate, we’ll be masking every of the safety advantages supplied together with your journey insurance coverage plan.

Emergency Medical Protection

Getting sick or injured overseas can do extra injury than simply ruining your trip. However with out journey insurance coverage, it might additionally go away you with hundreds of {dollars} in hospital payments and medical bills.

With emergency Medical Protection, you’re protected in opposition to every little thing from last-minute physician visits to long-term hospital stays. So for those who get meals poisoning in India or catch the extreme flu in Brazil, you’ll be reimbursed for any needed medical prices.

Emergency Transportation

Allianz International Help additionally covers transportation prices wanted to get you safely to the hospital. So as an illustration, for those who break your leg snowboarding within the Alps, you’ll must be airlifted to the closest medical facility for fast care.

And within the uncommon occasion that it’s good to be flown again dwelling, emergency transportation will even cowl these prices.

Journey Cancellation

If it’s good to cancel your journey earlier than you permit, then journey cancellation protection will reimburse you for any unused bills, like flights or resort stays.

Nonetheless, your purpose for canceling must be lined beneath the Allianz coverage. Allianz has 26 lined causes, together with pure disasters, visitors incidents or illness, demise or the beginning of a member of the family.

Journey Interruption

In case you’re already on trip however must return dwelling early, then journey insurance coverage additionally has your again. Journey Interruption protection reimburses you for the unused portion of your journey in case it’s good to return dwelling early as a consequence of a lined purpose.

And in some instances, you’ll even be lined for any additional prices related to getting dwelling, like reserving a brand new flight.

Baggage Loss/Harm

Allianz International Help comes with protection to your misplaced, stolen or broken private belongings. For instance, in case your iPhone or digital camera will get stolen when you’re on a prepare, then your journey insurance coverage coverage will cowl a part of the fee.

Every plan comes with a unique quantity of protection. And it’s necessary to notice that there’s a strict per article restrict. With Allianz International Help, you possibly can solely declare as much as $500 per merchandise. Which means for those who lose your $2,000 DSLR digital camera, you’ll solely get reimbursed $500.

Baggage Delay

In case your checked baggage is delayed or misplaced by the air provider for greater than 12 hours, then you definately’ll be lined by the luggage delay profit. Which means you can be reimbursed for any needed toiletries or objects it’s good to buy till your bag arrives.

Journey Delay

Allianz International Allianz additionally covers you in case you’re unable to succeed in your vacation spot on time as a consequence of circumstances exterior your management. For example, in case your airways cancel your flights as a consequence of unhealthy climate, then the insurance coverage firm will reimburse you for any meals, transportation or lodging prices.

It’s necessary to notice that journey delay protection kicks in solely in case you are delayed for six hours or extra.

Change Price Protection

There could be a scenario the place you merely want to alter the dates of the flight, reasonably than canceling the complete journey. In case you have the AllTrips Govt, OneTrip Prime or OneTrip Premier plan, the plan will reimburse you as much as $500 to cowl the price of the airline change price.

Loyalty Program Redeposit Price Protection

With Allianz International Help, even if you buy flights or lodging utilizing miles or factors, the corporate will defend you. The loyalty program re-deposit price protection redeposits your factors in case it’s good to cancel your flight or lodging for a lined purpose.

Notice that solely the AllTrips Govt, OneTrip Prime, and OneTrip Premier plans include the loyalty program redeposit price profit. All three plans cowl as much as $500 price of frequent flier miles or loyalty program factors.

Enterprise Gear Protection

In case you journey for work, you could be bringing alongside company-paid tools like laptops, telephones and different tools. And for those who lose or break this tools in your journey, Enterprise Gear Protection will reimburse the related prices to repair or substitute them.

Nonetheless, the one plan to supply safety for enterprise tools is the annual AllTrips Govt plan.

Journey Accident Protection

Also referred to as unintentional demise and dismemberment, the journey accident protection pays you or your loved ones for those who get into an accident whereas touring. This consists of protection in opposition to the lack of a limb, eyesight, or within the worst scenario, demise.

Rental Automotive Harm and Theft Protection

For simply $9 a day, annual plan holders can defend themselves in opposition to collision, injury, or theft of a rental automotive. With this protection, you don’t must take out an extra coverage on the rental automotive desk!

This profit will not be out there to all US residents. Please seek the advice of your Allianz International Help coverage for extra data.

Allianz Journey Insurance coverage Evaluate: International Help Insurance coverage Plans

Whereas all Allianz International Help journey insurance coverage embrace some or all of the aforementioned protection, they every break down otherwise. For this Allianz International Help journey insurance coverage evaluate, we’ll evaluate the totally different plan choices out there. Relying in your journey wants, Allianz presents 9 totally different journey insurance coverage to select from.

In case you want protection for one journey, then you can purchase a single-trip plan. The 5 single journey plan choices embrace:

- OneTrip Cancellation Plus Plan – Greatest Choice for Vacationers Who Don’t Want Medical Protection

- OneTrip Emergency Medical Plan – Greatest Choice for Vacationers Needing Primary Medical Protection

- OneTrip Primary – Greatest Choice for Vacationers on a Finances

- OneTrip Prime – Greatest Choice for the Common Traveler

- OneTrip Premier – Greatest Choice for Vacationers In search of the Highest Protection

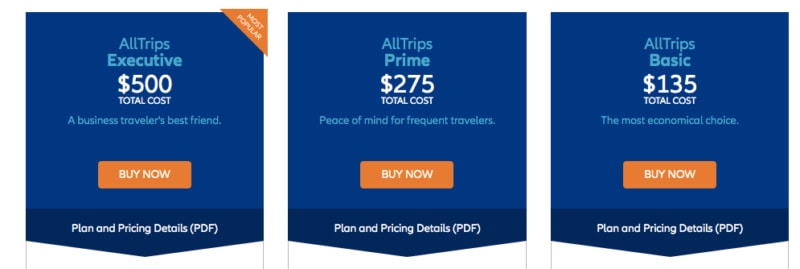

However, taking a number of smaller journeys all year long makes an annual, multi-trip plan more cost effective. Annual plans cowl you for a whole 12 months of journey, no matter for those who keep home or journey abroad. There are 4 annual plans to select from:

- AllTrips Primary – Greatest Choice for Vacationers Needing Primary Medical Protection

- AllTrips Prime – Greatest Choice for the Common Traveler

- AllTrips Govt – Greatest Choice for Enterprise Vacationers

- AllTrips Premier – Greatest Choice for Vacationers In search of the Highest Protection

Moreover the size of journey, there are a number of important variations between the one and annual-trip plans. For one, the annual journey plans solely cowl a set quantity for journey cancellation or interruption. However with a single-trip plan, you’re lined for one hundred pc or 150 p.c of your whole journey price.

One other distinction is that every one annual plans provide Unintentional Demise and Dismemberment (AD&D) protection, in addition to rental automotive injury safety. The one single-trip plan to supply AD&D is the OneTrip Emergency Medical Plan. So, it’s important to contemplate these components when buying the precise journey insurance coverage coverage to your journey.

1. OneTrip Cancellation Plus Plan

The OneTrip Cancellation Plus Plan is Allianz’s most reasonably priced coverage. With this plan, you’re solely protected in opposition to journey cancellations, interruptions and delays. It’s necessary to notice that medical protection, medical transportation and baggage loss will not be included.

And when you aren’t lined for journey cancellations, you do get $2,000 in baggage loss or injury protection and $10,000 in unintentional demise or dismemberment. This plan is for anybody on a funds who is generally involved about interruptions to their journey plans, however not too involved about all the remainder.

2. OneTrip Emergency Medical Plan

In case you are keen to forgo journey cancellation and interruption protection, then the OneTrip Emergency Medical Plan is an enough possibility for insurance coverage. You’ll obtain $50,000 in emergency medical protection, in addition to $250,000 in emergency medical transportation protection.

Needless to say this plan solely presents safety for medical bills. If the airways lose your baggage or if it’s good to cancel your journey, you will have to pay these bills out of pocket. This plan is, due to this fact, for anybody who could also be occurring an adventurous journey and is generally involved about their well being and security, however is much less so involved with every little thing else.

3. OneTrip Primary

Excellent for funds vacationers who wish to cowl every little thing from medical must flight cancellations, the OneTrip Primary plan offers protection in opposition to getting sick, needing medical evacuation or having to cancel your journey.

Included within the OneTrip Primary plan is $10,000 of medical and dental protection and $50,000 price of medical evacuation. And whereas that will sound like quite a bit, it may not cowl your complete evacuation price, particularly if it’s good to be airlifted again dwelling. For that purpose, you may contemplate a extra complete coverage for those who plan to journey overseas or to a distant nation.

The OneTrip Primary plan additionally reimburses as much as $500 for misplaced or stolen baggage and $200 for delayed baggage.

However better of all, the OneTrip Primary plan will reimburse the total price of your journey if it’s good to cancel or go away early. The truth is, every single-trip plan with Allianz covers one hundred pc of your bills for journeys as much as $100,000. Nonetheless, the rationale for canceling must fall inside Allianz International Help’s record of lined causes.

It’s necessary to notice that there are a number of limitations to the OneTrip Primary plan. Not like the opposite Allianz International Help plans, the OneTrip Primary plan doesn’t embrace protection for missed connections or airline change charges. And, there are fewer lined causes for journey cancellation.

4. OneTrip Prime

The OneTrip Prime plan is the most well-liked possibility for the common traveler. You’ll get $25,000 price of medical and dental protection together with $500,000 price of emergency evacuation protection.

Relating to misplaced and stolen baggage, the OneTrip Prime plan consists of $1,000 in protection. Nonetheless, you’ll solely obtain a most of $500 per bag or merchandise (as much as $1,000 whole). Which means for those who’re touring with costly gear, the misplaced baggage protection may not cowl the complete price.

You’ll additionally get $300 in baggage delay prices, $800 in missed connection protection, and as much as $250 for airline change charges. These are fairly beneficiant bonus advantages!

And for those who cancel, you’re lined for one hundred pc of the unused whole journey price. But when it’s good to go away early, OneTrip Prime additionally reimburses as much as 150 p.c of the journey price. Which means you gained’t have to fret about elevated transportation prices to get again dwelling!

5. OneTrip Premier

In case you’re in search of probably the most complete protection possibility, then the OneTrip Premier plan is for you. It almost doubles all of the protection quantities of the OneTrip Premier plan and features a few additional advantages.

Medical and dental protection doubles from $25,000 to $50,000, whereas emergency evacuation protection additionally will increase to $1,000,000. With worldwide evacuation averaging round $100,000, this quantity is greater than enough to cowl your transportation again dwelling.

You’ll obtain as much as $2,000 in misplaced or stolen baggage. However just like the OneTrip Prime plan, you possibly can solely declare a most of $500 per merchandise (as much as $2,000 in whole). The OneTrip Premier plan additionally consists of $600 in baggage delay, $1,600 in journey delay, and $1,600 in missed connection protection.

6. AllTrips Primary

Essentially the most reasonably priced multi-trip plan is AllTrips Primary. This plan consists of $20,000 in emergency medical protection and $100,000 in emergency transportation protection.

However one of many greatest drawbacks is that the AllTrips Primary plan doesn’t include journey cancellation or interruption protection. Do not forget that means you’ll not be reimbursed in case you’re unable to go in your journey!

Nonetheless, you’re lined as much as $1,000 for misplaced or broken baggage, $200 for luggage delay and $300 for journey delay. The AllTrips Primary plan additionally comes with rental automotive injury and theft protection as much as $45,000.

7. AllTrips Prime

The $20,000 emergency medical protection and $100,000 emergency transportation protection with the AllTrips Prime plan is an identical to the AllTrips Primary plan. The luggage loss, baggage delay and journey delay protection are additionally the identical.

Nonetheless, the AllTrips Prime plan consists of $2,000 protection for journey cancellation and $2,000 protection for journey interruption. If you wish to be protected for any doable journey adjustments, then be certain to buy an AllTrips Prime, Govt or Premier plan.

8. AllTrips Govt

Catering to the enterprise traveler, the AllTrips Govt plan consists of complete medical and journey protection together with a number of additional advantages. Emergency medical protection will increase to $50,000, and emergency transportation rises to $250,000. Additionally, you will obtain $5,000 in journey cancellation and journey interruption protection.

And in contrast to the opposite plans, the AllTrips Govt plan comes with enterprise tools protection. So for those who journey all through 12 months for work, your work laptops, telephones and different electronics are protected in opposition to theft or injury.

9. AllTrips Premier

Though the AllTrips Premier plan is dearer, it’s additionally extra complete in comparison with the opposite annual journey insurance coverage. You’ll be lined for as much as $50,000 in emergency medical and $500,000 for emergency medical transportation. This plan is for these with an even bigger funds.

The AllTrips Premier plan additionally consists of $2,000 in journey cancellation and interruption protection and $1,500 in journey delay protection. On high of that, you additionally get $50,000 in journey accident protection for those who lose a limb or your eyesight when touring.

Allianz Journey Insurance coverage Value

The price of your journey insurance coverage coverage is dependent upon components like your age, residence state, journey size and whole journey price.

Let’s take a look at a number of examples to find out a possible coverage worth.

On this first situation, you’re a 28-year-old backpacker from Washington State who’s planning to spend a month touring round Thailand. The overall worth of your journey is roughly $2,000, together with the flight and hostel.

The price breaks all the way down to $4.06 per day for the OneTrip Primary plan, $4.56 per day for the OneTrip Prime plan and $6.16 per day for the OneTrip Premier plan.

Though the distinction in price could also be small, you’ll obtain extra advantages with the OneTrip Prime and Premier plans. For example, the protection quantity for medical emergencies, evacuations and journey delay is increased than the OneTrip Primary plan.

However let’s say you additionally plan to journey to Ecuador, China and Hawaii later within the 12 months. As an alternative of buying extra single-trip plans, you possibly can spend money on the annual plan to avoid wasting on journey insurance coverage prices.

The AllTrips Prime plan prices slightly below a greenback per day and protects you on all journeys for a 12 months! Though protection barely differs between the OneTrip and AllTrip plans, you’ll lower your expenses in the long run as a substitute of buying 4 particular person single-trip plans.

On this subsequent instance, you’re a 25-year-old Californian road-tripping round Europe for 2 months. Though you intend to go to Italy, Austria, Switzerland and France, you’ll spend nearly all of your time in Germany. Between flights, trains and motels, your journey prices round $5,000.

In your Eurotrip, you possibly can anticipate to pay $5.26 per day for the OneTrip Primary plan and $5.95 for the OneTrip Prime plan. And if you’d like probably the most complete journey insurance coverage protection, you possibly can pay $6.60 per day for the OneTrip Premier plan.

So you possibly can defend your self in opposition to huge medical payments and journey incidents for just some {dollars} a day. You’ll have full protection and peace of thoughts!

What’s Not Lined by Allianz Journey Insurance coverage?

Allianz International Help covers a variety of accidents and incidents that may occur in your journey. Nonetheless, there are a number of limitations to notice when buying an Allianz International Help coverage.

Excessive Sports activities Protection

Allianz Journey doesn’t defend you in opposition to any excessive danger or excessive actions. This consists of, however will not be restricted to, mountaineering, bungee leaping, or scuba diving. If you need protection for any adventurous actions in your journey, we suggest World Nomads journey insurance coverage, which covers over 200 thrilling sports activities and adventures.

Pre-Current Medical Circumstances

Usually talking, Allianz International Help doesn’t cowl any pre-existing medical circumstances whereas touring.

The look-back interval for a pre-existing situation is 120 days. That signifies that you probably have a prognosis or situation inside 120 days of your journey, you can’t declare the medical invoice as an insurance coverage expense.

Nonetheless, you could possibly get a pre-existing situation waiver if you buy journey insurance coverage inside 14 days of creating your first journey cost.

In case you do have pre-existing medical circumstances, we suggest that you simply take a look at Travelex insurance coverage, which does certainly cowl you. Now we have a full Travelex evaluate so that you can learn up on.

Professionals and Cons of Allianz Journey Insurance coverage

Professionals

- Number of Plan Choices: Relying in your journey insurance coverage wants, you’ll have 9 totally different plans to select from. Whether or not you’re taking one dream trip, or touring all year long for work, Allianz International Help has a variety of insurance coverage choices to suit your wants.

- Free Household Protection: The OneTrip Prime and Premier plans, in addition to the AllTrips Premier Plan, consists of protection for kids beneath 17 at no extra price.

Cons

- Low Protection with Some Plans: We suggest at the very least $100,000 in medical emergency and medical transportation protection. And whereas a few of the extra complete plans have enough medical transportation protection, the best quantity of medical emergency protection you possibly can have is $50,000.

- No Excessive Sports activities Protection: While you’re on trip, you may wish to take part in enjoyable and thrilling actions, like skydiving, climbing and snorkeling. Nonetheless, Allianz International Help doesn’t cowl these actions.

Allianz vs. Travelex vs. World Nomads

This Allianz Journey Insurance coverage evaluate wouldn’t be full with out rivals. Relying in your journey wants, Allianz International Help could be an appropriate journey insurance coverage supplier to your journey. However for this complete Allianz International Help journey insurance coverage evaluate, it’s necessary to take a look at different what different corporations provide by way of advantages. We’ll evaluate Allianz International Help with two totally different suppliers:

- Travelex

- World Nomads

Travelex

Based mostly out of Australia, Travelex offers comparable protection for Allianz International Help for roughly the identical worth. Each provide medical upgrades for pre-existing medical circumstances and rental automotive injury safety.

However whereas Allianz International Help presents 9 journey insurance coverage, Travelex permits for extra customizability. For instance, you possibly can add totally different advantages to your Travelex insurance coverage plan, together with cancel for any purpose safety.

Travelex additionally presents a paid improve for excessive sports activities and adventurous actions. That’s lacking from Allianz International Help insurance policies.

World Nomads

Created with backpackers and vacationers in thoughts, Australian based mostly World Nomads is without doubt one of the hottest names within the journey insurance coverage enterprise.

Nonetheless, one of many greatest downsides to World Nomads is the fee, particularly for those who plan to journey a number of instances all year long. For an annual plan, Allianz International Help’s most complete plan continues to be half the price of the essential World Nomads plan.

You’ll be able to’t customise World Nomads as a lot as Allianz International Help, because it solely presents two plans. Nonetheless, World Nomads presents a better most quantity for emergency medical reimbursement. Each World Nomad plans include $100,000 in protection. That is twice as excessive as Allianz International Help’s most complete plan.

On high of that, World Nomads consists of excessive sports activities protection with the value of the plan. So for those who’re planning on scuba diving or bungee leaping in your journey, the insurance coverage will fully cowl you in case something goes array.

Easy methods to File a Declare with Allianz Journey Insurance coverage

In case you run into an sudden incident overseas, you’ll wish to know find out how to file a declare with Allianz International Help. This fashion, the insurance coverage will reimburse you for any medical payments or misplaced bills you incur.

Doc the Incident or Accident

Relating to submitting a declare, gathering the suitable documentation is without doubt one of the most important steps. It’s your accountability to observe up with the precise authorities. It’s additionally on you to gather the mandatory paperwork for submitting a declare.

Seek the advice of the Allianz International Help declare documentation guidelines to see precisely what types and paperwork you want as a way to submit your declare.

File the Declare On-line

As a part of this Allianz Journey Insurance coverage evaluate, let’s dive into find out how to file a declare. Submitting a declare with Allianz International Help is comparatively simple. You are able to do it completely on-line or in your cellular system. You’ll enter particulars concerning the incident and fasten your supporting documentation to the declare.

Nonetheless, it’s crucial to notice that you’ve got solely 90 days to submit the declare with Allianz International Help. They might have additional questions concerning the request. In that case, they’ll contact you for extra data by way of e-mail or phone.

It might take round 10 enterprise days for them to evaluate your declare. If the corporate accepts your declare, it’ll pay you by test, debit-card deposit or direct deposit.

Ultimate Ideas

There are dozens of journey insurance coverage corporations in the marketplace right now. However discovering the precise supplier to your wants doesn’t should be sophisticated. One of many greatest names, Allianz International Help is a superb possibility for vacationers in search of short- or long-term protection, as this Allianz Journey Insurance coverage evaluate suggests.

Allianz International Help will cowl you for these unpredictable and unforeseeable occasions. From damaged digital camera lenses to damaged bones, you’ll really feel somewhat extra comfy touring the world with insurance coverage to guard you.

However don’t simply take our phrase for it. Get your free quote and see if Allianz International Help is best for you.

![Allianz Travel Insurance Review [2023 UPDATE]](https://leslynewsmagazine.online/wp-content/uploads/2019/06/allianz-travel-insurance-review.jpg)