As a traveler, you know that travel insurance is by far the most important thing to purchase before you leave. But with dozens of companies to choose from, picking a reliable travel insurance company can be difficult. During your research, you might have stumbled upon Travelex Insurance and wondered if they would be a good fit for your trip.

But before you choose a travel insurance provider, there are several factors to review. The best policy should provide coverage for medical emergencies, trip cancellation and interruption, and lost or damaged property. You should also look for a company with good reviews and excellent customer service.

In this Travelex insurance review, we’ll find out if Travelex ticks all those boxes. And if not, then we’ll help you figure out how to choose the best travel insurance.

Travelex Insurance Review: The Basics

Let’s start this review by covering a few basics when it comes to Travelex Insurance.

- Travelex offers five insurance plans for trips ranging from one day to one year. There are three comprehensive travel plans and two flight-only plans. Each plan provides primary coverage with no deductible.

- You also have the option to customize your plan with a variety of add-ons. On top of that, each plan also comes with Travel Assistance and a 24/7 hotline for emergencies or concierge services.

- When it comes to filing a claim, Travelex makes the process relatively straightforward. Claims can be filed online for review or in the Travelex app and are backed by a A++ rating from Berkshire Hathaway Specialty Insurance Company.

Who Is Travelex?

Before we start the review, let’s talk about who Travelex Insurance is as a company. Headquartered in Omaha, Nebraska, Travelex has been providing travel insurance services for the past 25 years.

In 2016, they were acquired by Australia’s largest insurance company, the Cover-More Group. The company’s insurance benefits and claims are also underwritten by Berkshire Hathaway Specialty Insurance Company and TransAmerica Casualty Insurance Company.

As a result, the acquisition allowed Travelex to expand internationally to become one of the most trusted names in the travel insurance business.

Who Is Travelex Insurance For?

While every traveler should have travel insurance, there are certain people that would benefit specifically from a Travelex Insurance policy.

- Families Traveling Together: Children under 18 get to travel for free, which makes Travelex a great option for families. And if you have multiple children, there’s no extra fee to bring them along.

- Senior Travelers: With a Travelex, there’s no age limit for policy holders. Unlike other companies that only cover travelers up to age 65, Travelex offers comprehensive protection for travelers of any age.

- Travelers with Pre-Existing Conditions: These policies have one of the shortest look-back periods for pre-existing conditions. While other companies have a window of 180-days, Travelex’s window is just 60 days. They also offer a pre-existing medical condition exclusion waiver to cover your condition while you’re abroad.

Who Isn’t Travelex Insurance For?

In this review, it’s important to discuss that Travelex might not be a good fit for certain types of travelers. Although it’s a great insurance option for most people, it’s not for everyone.

- Travelers Wanting High Medical Coverage: I recommend traveling with at least $100,000 in medical protection. Unfortunately, the amount is capped at $50,000. Although you can add another $50,000, it’s not included in the quoted price. Dental coverage is also capped at a certain amount, and might not protect you for serious injuries or surgeries. For a company that comes with $100,000 with every policy, read this World Nomads travel insurance review.

- Travelers With Expensive Gear: The lost or damaged baggage amount is low compared to other travel insurance policies. There is also a per article limit, which only reimburses a certain amount per claimed item. If you need extra protection, you should review a supplemental policy with InsureMyEquipment.

- Open-Ended Travelers: While Travelex will cover you for up to a year of travel, Safetywing will cover you for as long as you want. That’s why we chose it as our best long term travel insurance.

If Travelex sounds like the right insurance for you so far, fill out the form below for a free quote!

What’s Included in Travelex Insurance?

As a future customer, there are many benefits included with your Travelex Insurance policy. For this review, we’ll dive deeper and see what’s included with your travel insurance policy.

Medical Coverage

Getting sick or injured is one of the worst scenarios that could happen during your trip. But with medical benefits, you’ll be protected in case you need to see the doctor or visit the hospital while abroad.

Without medical protection, you could be stuck with thousands of dollars in hospital bills and expenses. Travel insurance will make sure you get the care you need while also reimbursing the cost of any necessary treatments.

Emergency Transportation

If you get injured, chances are, you’ll need to be transported to the nearest medical facility for care. Emergency evacuation covers the ambulance ride or flights needed to take you to the hospital.

Emergency evacuation is essential if you’re traveling to a remote country where healthcare may not be easily accessible or up to hygienic standards.

Trip Cancellation

Unfortunately, there may be situations where you’ll have to cancel your trip altogether. If you have trip cancellation coverage, then you’ll be reimbursed for any non-refundable flights and hotel stays.

Unless you have “cancel for any reason” coverage, your reason for canceling your trip needs to be covered by the company. Situations like illness, death of a family member, and natural disasters are all covered. If you aren’t completely sure about what’s a valid reason for cancellation, review your policy terms.

Trip Interruption

Travelex Insurance also provides coverage in case you need to leave your trip early. They will reimburse for any unused and non-refundable portions of your trip, like flights and accommodation.

Like trip cancellation coverage, trip interruption coverage only kicks in if you leave for a specified reason.

Missed Connections

If your flight is canceled or postponed for more than three hours, you’ll be grateful for the fact that you have missed connection coverage.

Not only will you be reimbursed for the missed portion of the trip, but they will also pay for transportation to get you to your destination.

Baggage Loss/Damage

With Travelex Insurance, you’ll be covered in case your personal items get lost, stolen, or damaged during your trip. From lost luggage to broken sunglasses, you’ll get reimbursed up to a certain amount for your items.

Expensive items usually need to be accompanied by the original purchase receipt. There may also be limitations on what can be claimed, like smartphones, passports, and cash. Review the terms first! And learn some smart ways to keep your stuff safe when you travel.

Baggage Delay

If your bag is delayed or misdirected by the airlines, then Travelex will pay for any items you need until your bag arrives. You’ll be reimbursed for toiletries, clothing, or other necessary items.

Keep in mind that the bag must be delayed for at least 12 hours in order to take advantage of this benefit.

Accidental Death and Dismemberment

Serious accidents can happen during your flight or your trip. With Accidental Death and Dismemberment (AD&D), you’ll be compensated if you suffer a serious injury like losing an arm or eye.

And in the worst-case scenario, AD&D will also pay a certain amount to your family if you die during your trip.

Optional Plan Upgrades

For an additional fee, you can add one of the following upgrades to your plan. However, it’s important to keep in mind that these upgrades are only available for the Travel Select plan.

- AD&D Common-Carrier Air Only: While your plan comes with basic AD&D, you can also purchase coverage to protect against injuries that could occur while you’re flying to your destination.

- Car-Rental Collision Coverage: If you plan on renting a car, then consider purchasing supplemental car rental protection. You’ll be protected against vandalism, collision, natural disasters, and theft.

- Adventure Sports: Hot air balloon tours, helicopter tours, sky-diving, and mountain climbing are just a few activities covered by the adventure sports package.

- Cancel for Any Reason: Normally, Travelex will only reimburse the non-refundable costs of your trip if you cancel for a certain reason. By adding this benefit, you’ll get up to 75% for trip cancellation, regardless of your reason for canceling.

- Medical Upgrade: The Travel Select plan comes with $50,000 in medical protection. With the medical upgrade, you can add an additional $50,000 to your policy.

Travelex Insurance Plans

As part of this review, we’ll discuss in detail the five different Travelex plans you can choose from. The Travel Basic, Travel Select and Travel America plans are robust policies that offer both medical and trip-related emergencies.

- Travel Basic – Best Comprehensive Option for Travelers on a Budget

- Travel Select – Best Comprehensive Option for Travelers Looking for the Highest Coverage

- Travel America – Best Comprehensive Multi-Traveler Option for short getaways in the United States

However, Travelex also offers two flight-only plans. If you want protection for emergencies that could occur while you’re flying to your destination, then you can choose between the two Flight plans.

- Flight Insure – Best Option for Travelers Needing Protection While Flying

- Flight Insure Plus – Best Option for Travelers Who Don’t Need Trip Coverage

There are several key differences between the Travel and Flight plans. For one, the Travel Basic, Travel Select and Travel America plans offer comprehensive benefits in case you get sick or injured during your trip. Both plans also reimburse for last-minute trip cancellations or trip interruptions.

Each Travel Plan also comes with a 60-day pre-existing look back period and pre-existing condition waiver for early purchase. If you have a medical condition you would like covered, then it’s crucial to invest in one of these plans.

Neither of the flight-only plans will protect you if you have to cancel or leave your trip early. And while the Plus plan comes with limited medical emergency coverage, it does not include a pre-existing condition waiver for early purchase.

1. Travel Basic

The Travel Basic plan is an affordable option with some medical and trip protection benefits. You’ll receive $15,000 in medical benefits as well as $500 for dental. This amount might not cover serious injuries or accidents, so I would recommend a more comprehensive policy if you plan to travel abroad.

This plan also comes with $100,000 in emergency evacuation.

If you need to cancel or leave early, you will be reimbursed 100% of your total trip cost up to $10,000. Other benefits include $500 for missed connections and $500 for lost or damaged baggage.

On top of these benefits, you’ll also have $10,000 in Accidental Death and Dismemberment (AD&D) coverage.

This plan is only available for trips under 30 days. If you plan to take a gap year or spend a few months backpacking through Europe, you will need to purchase one of the other plans mentioned in this review (see below) or check out our review of the best backpacker travel insurance.

2. Travel Select

Ideal for long-term travelers looking for a high level of coverage, the Travel Select plan is a great option. Not only does it include $50,000 in medical coverage, but also $500,000 in emergency evacuation.

This plan also covers 100% for trip cancellations and 150% for trip interruptions up to $50,000. And if you lose or damage any personal items, you’ll have $1,000 in baggage protection.

With the Travel Select plan, you’ll also receive $25,000 in AD&D coverage.

The Travel Select plan can be used for trips up to a year long. And unlike the Travel Basic plan, you can upgrade with add-ons for an additional fee. Adventure sports and increased medical emergency coverage are only available with Travel Select. This plan is definitely one of the most comprehensive coverages in this review.

3. Travel America

The Travel America plan is a low cost, domestic travel insurance for short getaways within the United States. It was designed as a response to travel trends during the COVID-19 pandemic and comes with an “inconvenience benefit” for venues or events that may be closed due to certain conditions (like ski resorts, beaches, and golf courses).

You and up to seven traveling companions will have shared benefits, including $50,000 in medical coverage and $25,000 in emergency evacuation.

This plan is designed for short term travel (like a weekend family getaway), so although it covers 100% for trip cancellations and 150% for trip interruptions, that includes only up to $750 and $1,125, consecutively.

However, the Travel America plan just $60 — flat rate!

4. Flight Insure

The Flight Insure provides basic protection against emergencies that could happen during your flight.

The only major benefit to this plan is having Accidental Death and Dismemberment coverage in case there is an accident during your flight. You can choose between $300,000, $500,000, or $1 million in coverage. Keep in mind that AD&D for this plan only covers flights and not any other situation during your trip.

In addition to AD&D coverage, you’ll also receive $100 if your flight is delayed for more than five hours.

However, this plan does not come with medical or evacuation benefits or trip interruption and cancellation protection.

5. Flight Insure Plus

The Flight Insure Plus plan is a more robust offering to the basic flight plan. While you still have AD&D coverage for $300,000, $500,000, or $1 million, there are additional benefits for extra protection during your trip.

A small amount of medical coverage is included in this plan. You get $10,000 in emergency medical with a $500 dental sub limit, and $100,000 in emergency medical evacuation. As you can see, this is almost the same level of medical coverage included with the Travel Basic plan.

With the Plus plan, you’ll also get $100 in trip delay coverage, $1,000 in personal baggage coverage, and $500 in baggage delay coverage. However, there is no trip cancellation or interruption coverage.

When to Purchase Travel Insurance

Most companies will allow the customer to purchase a plan days, weeks, or months before their trip starts.

I recommend buying a plan as soon as you book part of your flight or accommodation. That way, you’ll be protected by the trip cancellation benefit in case you need to cancel before you leave.

The great thing about Travelex is that your policy starts immediately. You’ll be covered the following day after you make your insurance payment.

And if you are living with a pre-existing condition, you can take advantage of one giant benefit when booking early. If you purchase a plan within 15-21 days of the initial trip deposit, you may qualify for a pre-existing condition waiver. This way, your condition will be covered in case you need to seek treatment while traveling abroad.

Your policy also comes with a 15 day lookback period. So, for if any reason you want to cancel your plan, you can up to 15 days before your scheduled departure date.

Travelex Insurance Trip Cost

There are several factors that contribute to the total price of your Travelex Insurance quote. Namely, your age, location, and the anticipated value of your trip.

For this review, I have a few scenarios to help you understand how much you can expect to pay for trip insurance with Travelex. For an exact quote, you can enter your trip details on their website.

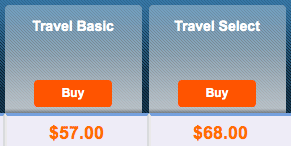

In this example, you’re a 28-year old traveler from Washington State who’s spending a month backpacking through Europe. Between the flights, train tickets, and hostel rooms, the value of your trip is around $2,000.

For you as the customer, the basic plan quote for one month is only $57, or $1.90 per day. But for just $11 more, you can purchase the select plan, which has higher coverage for medical emergencies, evacuation, and lost baggage.

In this next scenario of this review, you are traveling through Asia for three months. The Travelex basic plan only covers trips up to 30 days, so you will need to purchase the select plan for longer trips.

Thankfully, Travelex is relatively affordable for long trips. The most influential factor when determining your insurance price is the value of your trip. So, if you stick to a budget, you can travel for months while paying only a minimal amount for travel insurance.

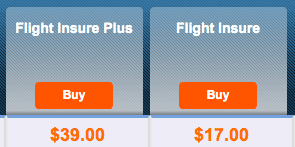

While I strongly recommend that you purchase a comprehensive travel insurance plan, Travelex also offers two flight-only policies.

Since these plans only protect your flights, the price stays the same regardless of your trip’s length.

The cheapest flight plan quote is just $17 but doesn’t include anything besides AD&D and trip delay. However, the $39 plan comes with some medical benefits. If you’re deciding between one of the two flight-only plans, it’s worth spending the extra few dollars to protect yourself with one of the two comprehensive plans.

What’s Not Covered by Travelex Insurance?

Although Travelex offers protection for a wide range of incidents, it still has its limitations. As part of this review, we’ll cover a few things that are not included with your policy.

Expensive Items or Equipment

The lost or damaged baggage coverage with Travelex only covers up to $500 per item. And if you’re traveling with jewelry, cameras, or laptops, then the $500 limit is aggregated for those specific items.

That means you won’t get reimbursed for the full amount for your expensive DSLR or smartphone.

Routine Check-Ups

As with most travel insurance plans, you are not covered for general doctor visits. If you see a doctor for a check-up or any non-emergency related treatment, then you will not be reimbursed for your medical bills.

Routine dentist visits, mental health appointments, or replacement of eyeglasses or contact lenses are also excluded from your policy.

Reckless or Risky Behavior

It’s important to note in this review that you are not covered for any injuries or illnesses that occur when you are acting recklessly. This includes any losses related to drugs and alcohol.

So, if you arrive at the hospital over the legal blood alcohol limit, you will not be able to reimburse your medical bills to Travelex travel insurance.

Pros and Cons of Travelex Insurance

Pros

- Variety of Add-Ons: With the Travel Select or Basic plans, you have the option to customize your policy with an upgrade. You can add car rental collision, AD&D for your flight, adventure sports upgrade, and cancel for any type of reason protection.

- Free Family Protection: Children under 18 years who are traveling with their parents are protected under the same policy at no additional charge.

- Pre-existing Medical Benefits: With a look-back window of just 60 days, the Select and Basic plans are great options for travelers with pre-existing conditions. As a Travelex customer, you can also sign a medical condition exclusion waiver to cover conditions outside that look-back window.

Cons

- Low Medical Benefits: I recommend always traveling with at least $100,000 in medical protection for emergencies. While you have the option to increase the maximum amount on the Travel Select plan, the Basic plan caps at $15,000, which is far too low, in my opinion.

- One Plan for Long-Term Travelers: If your trip is longer than 30 days, then you can only purchase the Travel Select plan. Although it’s cheaper, the Basic plan is only available for trips shorter than 30 days.

Travelex vs. Allianz vs. World Nomads

When you’re looking at options for trip insurance, you might come across a few other travel insurance companies during your search. Travelex is a great option for some types of travelers. But depending on your travel needs, there may be other companies that would be a better fit for your trip.

In this review, we’ll compare Travelex with two other competitors:

- Allianz Global Assistance

- World Nomads

Allianz Global Assistance

As one of the top insurance providers in the world, Allianz offers nine different insurance plans for short and long-term travelers. From single trip emergency only plans to multi-trip business plans, you’ll have more options and flexibility with Allianz.

For the customer, an Allianz insurance plan costs roughly the same as a Travelex insurance plan. And both companies offer specific upgrades, such as pre-existing medical conditions and rental car damage protection.

Allianz also has a top-notch customer service team and a 24/7 phone line for emergencies.

In addition, Allianz also includes coverage for families traveling with children under 17 at no additional cost.

For more, you can read our full Allianz Travel Insurance Review.

World Nomads

Based out of Australia, World Nomads is a travel insurance company explicitly designed with travelers and backpackers in mind.

Like Travelex, World Nomads has two different plans to choose from. However, one of the biggest differences is that both plans offer $100,000 in medical protection, which is a lot higher than the $15,000 (basic) or $50,000 (select) with Travelex.

If you plan on doing any extreme sports, then World Nomads is a better option. They include protection for over 300 activities, like sky diving and surfing with the price of the plan.

The biggest downside to World Nomads is price. Their basic offer costs more than twice as much as the basic plan with Travelex. If budget is a concern, then World Nomads might not be the best option for your travels. Don’t forget to read our full World Nomads travel insurance review!

How to File an Insurance Claim with Travelex

Travelex makes it relatively easy for the customer to get reimbursed for medical bills, missed flights, or any other emergency situations abroad. If you need to file a claim, then it’s important to understand how the reimbursement process works. This review will tell you how.

Call Customer Service

Every plan comes with Travel Assistance, a 24/7 customer phone line that can assist with emergencies and send the required documentation list for completing the claim. You should review this info before your travels and keep it handy in case you need to use it.

In the event of a serious emergency, you should always go straight to the hospital or police station. If you still need further assistance, then you can always ask the customer service department for the next steps after you are situated.

Document the Incident

As with any other company, you’ll need to submit your claim with supporting documents for review. That means you’ll need to follow up with the authorities to make sure you have the necessary paperwork to submit to the company.

As the consumer, it’s your responsibility to collect all the documents needed for the claim. The more info you offer, the quicker your review will be completed.

For example, you will need a full medical review to get reimbursed for a hospital visit. And if you lose or have something stolen, then you’ll need an official report from the local police.

File the Claim Online

For this review, we’ll outline how you can file a claim with Travelex or Berkshire Hathaway Specialty Insurance. To start the claim filing process, you’ll need your Brochure or Plan Number.

You can file the claim online, through the “Travelex Insurance” mobile app, or by calling the customer service phone line. After providing information about the incident, you’ll need to submit the supporting documents and customer paperwork for review.

However, you should keep in mind that you only have 90 days to submit a claim. After you submit your files, the customer service department will then review your claim. If accepted, you’ll receive your reimbursement within several weeks.

Is Travel Insurance Worth It?

From broken bones to stolen luggage, travel insurance protects you against financial losses that could happen during your trip. Although it’s unlikely that you’ll encounter a serious issue, it’s not worth risking thousands of dollars or possibly your life.

So, is travel insurance worth it? Yes, absolutely.

The cost of purchasing a plan is nothing compared to what you could lose. For just a few dollars a day, you can fully protect yourself against a variety of incidents and emergencies.

Not only that, but you’ll also have the peace of mind to relax and fully enjoy your well-deserved vacation! I hope this review has convinced you about the necessity of travel insurance.

***

Now that we’re at the end of our review, I hope you have a better idea of whether or not Travelex has what it takes to insure your trip. With decent trip cancellation and interruption benefits and generous pre-existing condition policies, Travelex could be a good fit for many travelers.

As you read through other Travelex Insurance reviews, it’s crucial to choose a provider that suits your needs. And most importantly, find a policy that protects you in different unpredictable situations.

If you’re ready to take the next step, then get a free quote with Travelex Insurance now.

![Travelex Insurance Review [2023 UPDATE]](https://leslynewsmagazine.online/wp-content/uploads/2019/12/travelex-insurance-review-scaled.jpg)