When trying to find journey insurance coverage, you’ll possible see one identify come up again and again. It’s World Nomads, and, in the event you’re interested in it, you’ve come to the precise place.

After ten years of utilizing them as my major journey insurance coverage, I lastly determined to take a seat down and write an entire and sincere World Nomads journey insurance coverage evaluation.

They’re one of the vital fashionable journey insurance coverage corporations in the marketplace—and it’s not exhausting to see why. With regards to offering top-of-the-line protection, the corporate is arguably your best option for most vacationers.

However it’s not essentially your best option for each traveler. This World Nomads journey insurance coverage evaluation will enable you to resolve if World Nomads is the corporate you need to insure your subsequent journey.

What Is Journey Insurance coverage?

Earlier than diving into this World Nomads journey insurance coverage evaluation, let’s, first, speak about journey insurance coverage basically, what it’s and why you want it.

Put merely, journey insurance coverage protects you in opposition to any unexpected accidents, emergencies or monetary losses it’s possible you’ll incur whereas touring.

A superb journey insurance coverage coverage ought to embrace the next:

- Journey cancellations, interruptions and modifications

- Stolen, misplaced, delayed or broken baggage and property

- (Often non pre-existing) medical remedies and bills

Take into account that journey insurance coverage is completely different out of your regular medical insurance plan. With home medical insurance, your protection is commonly restricted abroad. And, basically, medical insurance gained’t shield in opposition to different surprising occasions, like dropping your iPhone, getting pickpocketed or lacking your flight connection.

So why is journey insurance coverage so necessary? Effectively, it doesn’t simply shield your well being. It protects your complete journey.

In different phrases, it’s good to journey with each common medical insurance and journey insurance coverage as a result of they’re completely separate entities.

Is Journey Insurance coverage Actually Value It?

So, why do you even want journey insurance coverage within the first place and is it price it?

With regards to planning a visit, buying a journey insurance coverage coverage could also be the very last thing in your thoughts (and typically, for many vacationers, it really is!). Perhaps you’re not involved concerning the relentless blizzard that might cancel your flight. Or maybe you assume that the possibility of getting pickpocketed on the subway is slim.

However, spoiler alert: These items can completely occur.

The worth to repair your shattered digicam (or shattered femur) will undeniably price greater than what you’ll spend on journey insurance coverage. There’s no worse feeling than being caught with hundreds of {dollars} in charges or medical payments—belief me, I do know it from first-hand expertise.

Sure, journey insurance coverage is price it, as a result of touring with out it merely isn’t well worth the threat. The sincere fact is that in the event you can’t afford journey insurance coverage, you actually can’t afford to journey.

Should you can’t afford journey insurance coverage, you may’t afford to journey.

World Nomads does not cowl claims associated to COVID-19, except you find yourself in a medical emergency due to it (basically which means, in the event you occur to fall sick whereas touring).

There are a number of corporations on the market who provide CFAR (Cancel For Any Motive) protection, nonetheless the value does add up rapidly. If this can be a concern for you, I like to recommend doing a little extra analysis on Coronavirus journey insurance coverage.

When You Ought to Buy Journey Insurance coverage

You should purchase a journey insurance coverage coverage days, weeks and even months earlier than your journey begins. Some corporations require that you simply buy a plan a number of days earlier than your journey begins, to ensure that the complete protection to take impact.

Buying a plan prematurely is at all times a good suggestion. That’s largely as a result of one of many greatest advantages of getting journey insurance coverage is journey cancellation protection. Should you haven’t bought an insurance coverage coverage forward of time, then you definately gained’t be reimbursed for these unused journey prices.

However in between reserving flights, checking lodge costs and planning actions, it’s generally simple to overlook all about journey insurance coverage.

In that case, World Nomads has your again. Not solely are they top-of-the-line corporations in the marketplace right now, however they allow you to purchase a coverage after you’ve already left house.

In my expertise, I usually see folks purchase journey insurance coverage the day earlier than they journey. It’s the “oh shit” merchandise that most individuals forgot to choose up.

But when you realize you’re touring quickly, and you have already got the dates, don’t wait till the final minute. It’s higher to CYA and decide some up whereas it’s nonetheless in your thoughts.

Simply fill out the shape under for a free quote!

Who Is World Nomads?

At first, one thing I really feel it’s necessary to handle is that World Nomads is not the underwriter on your insurance coverage coverage. They’re not those who insure you—they’ve constructed vetted relationships with underwriters and insurance coverage suppliers all over the world—and standardized their choices—to match you with the precise one primarily based in your nation of residence and ultimate vacation spot(s).

They’re like an OTA for journey insurance coverage.

So with that mentioned, and earlier than we dive even deeper into this World Nomads journey insurance coverage evaluation, let’s get you launched to the corporate in query.

World Nomads is an Australian-based insurance coverage firm that was began by a fellow backpacker (and now angel investor), Simon Monk. Based in 2002, they’ve been defending vacationers for 17 years from over 150 nations by offering complete protection for each kind of journey.

However World Nomads is greater than your common journey insurance coverage supplier. The truth is, they go far past the decision of obligation by selling accountable journey all over the world.

For instance, following the 2004 Southeast Asian Tsunami, World Nomads launched the Footprints Community. This non-profit group permits vacationers to make a micro-donation to the event undertaking of their selection when buying an insurance coverage coverage.

In complete, they raised over $4 million {dollars} to fund greater than 200 initiatives.

Journey insurance coverage that protects your journey and the world? Now that’s one thing I can get behind.

Who Is World Nomads For?

At first, World Nomads was created by vacationers for vacationers. It’s particularly made for us globetrotters, wanderlusters and adventure-seekers. For that reason, I contemplate them to be the perfect journey insurance coverage for backpackers.

As a result of, let’s face it, backpackers have completely different journey necessities than different vacationers. You want an organization that understands your way of life (and, particularly on this case, your price range).

And to be sincere, backpackers may also be slightly reckless. That’s why you want further safety for all these exhilarating actions. From cave diving in Mexico to bungee leaping (bare) in New Zealand, World Nomads has a complete protection plan for each one among your adventurous moments.

However they’re not just for backpackers. They’re an excellent match for a lot of different varieties of vacationers, too.

- Lengthy-Time period Vacationers: You should purchase as much as one 12 months of journey insurance coverage protection. That applies to each single- and multi-trip plans.

- Vacationers With out a Set Plan: You’ll be able to replace your coverage, locations and journey dates on the go. Likewise, you may lengthen your protection if you wish to modify your journey or change your itinerary.

- Vacationers Who Forgot About Journey Insurance coverage: Should you’ve already hit the highway with out insurance coverage, don’t fear! You’ll be able to nonetheless buy a coverage.

- Vacationers Who Merely Need Peace of Thoughts: With intensive medical and baggage protection, you’ll be ready for no matter comes your method. Your time is healthier spent enjoyable and having enjoyable as a substitute of worrying about worst case eventualities.

Who Isn’t World Nomads For?

In an effort to verify this can be a brutally sincere and complete World Nomads evaluation, I’ll let you know straight up in the event that they’re not the precise firm for you. Whereas World Nomads is my favourite go-to supplier for many eventualities, it might not essentially match the wants of each kind of traveler.

- Senior Vacationers: They solely cowl vacationers below the age of 70. Senior vacationers are higher off buying a journey insurance coverage coverage with one other supplier, like Allianz Journey, which has no age restrict for policyholders.

- Vacationers with Costly Gear: As a result of the “Per Article Restrict” solely reimburses objects as much as a sure greenback quantity, you won’t have full protection on your costly laptop computer or digicam gear. On this case, InsureMyEquipment is the higher choice.

What’s Included in World Nomads Journey Insurance coverage?

This wouldn’t be an entire World Nomads journey insurance coverage evaluation if we didn’t take a deeper take a look at the safety advantages provided with a World Nomads journey insurance coverage plan.

Emergency Accidents & Illness Medical Bills

Your well being is among the most necessary issues to guard when touring overseas. From damaged bones to meals poisoning, you’ll need a complete medical emergency coverage to guard you when you’re within the hospital.

With out journey insurance coverage, you possibly can be caught with hundreds of {dollars} in medical payments. A superb coverage will embrace sufficient protection for minor physician visits to main surgical procedures.

Emergency Evacuation & Repatriation

Within the case of an emergency—and we’re speaking worst-case situation right here—there is perhaps situations wherein you’d have to be airlifted or flown to the closest hospital. For instance, in the event you break your arm in the midst of a desert safari, you’re going to wish a helicopter rescue to choose you up and take you to a medical facility.

Similarly, Emergency Repatriation will transport you again to your house nation in the event you require additional remedy. And within the unlikely occasion that you simply die abroad (fingers crossed you don’t), World Nomads will cowl the price of returning your stays again house.

Non-Medical Emergency Evacuation

Not all evacuations are attributable to medical emergencies. If an earthquake or tsunami hits whenever you’re on trip, World Nomads will cowl the transportation prices to get you again house. Emergency Evacuation additionally applies to nations with civil or political unrest.

Nevertheless, this profit shouldn’t be out there for some United States residents. Confer with your coverage for extra info.

Journey Cancellation

Generally incidents occur earlier than we even set foot on an airplane. If it’s essential to cancel your journey earlier than you allow, then World Nomads will reimburse your non-refundable journey bills.

It’s necessary to notice that you’re solely coated for a set variety of causes, as outlined by World Nomads. Some causes embrace illness, harm, demise or sickness of a member of the family, in addition to unexpected pure disasters.

A superb rule of thumb is to buy a coverage that covers the whole price of your journey.

Journey Interruption

Should you hit a bump within the highway when you’re already touring, then Journey Interruption will reimburse the remainder of your unused journey prices. The identical stipulations listed for Journey Cancellation additionally apply to Journey Interruption.

Journey Delay

Journey Delay covers you in case you’re unable to succeed in your vacation spot on time for circumstances outdoors of your management. For instance, in case your flight is delayed for greater than six hours, journey insurance coverage will cowl the unused lodging bills or pay for any extra bills wanted to get you the place it’s essential to go.

Baggage & Private Results

World Nomads additionally covers you for loss, theft and even harm to your private belongings. So as an illustration, in the event you drop your sun shades within the ocean or go away behind your digicam in a taxi, you’ll be capable of file a declare for reimbursement.

One factor to remember is that World Nomads enforces its per article restrict. Once more, this implies you could solely declare a sure greenback quantity for every merchandise. For instance, in the event you lose your $3,000 laptop computer, you’ll solely get again $500 with the Normal Plan, or $1,500 with the Explorer Plan.

Baggage Delay

World Nomads may even cowl the prices in case your checked baggage is delayed or left behind by the air provider. You’ll obtain every day compensation (as much as $750) to buy toiletries or no matter else it’s possible you’ll want till your bag arrives.

Unintended Dying & Dismemberment

Though dying or dropping a physique half in your journey is the last word worst case situation, it’s good to know that you simply’re nonetheless protected by World Nomads. On this scenario, Unintended Dying & Dismemberment protection pays you or your loved ones as much as a certain quantity.

Journey Sports activities & Actions

Touring and exhilarating adventures go hand-in-hand, and World Nomads has you coated for over 300 completely different actions. The listing is kind of intensive and consists of nearly every part below the solar from archery and canine sledding to cage combating and sizzling air ballooning.

Nevertheless, the kind of coated actions will fluctuate relying on the kind of plan you buy. You must seek the advice of your World Nomads coverage to substantiate in case your deliberate actions are coated.

World Nomads Journey Insurance coverage Plans

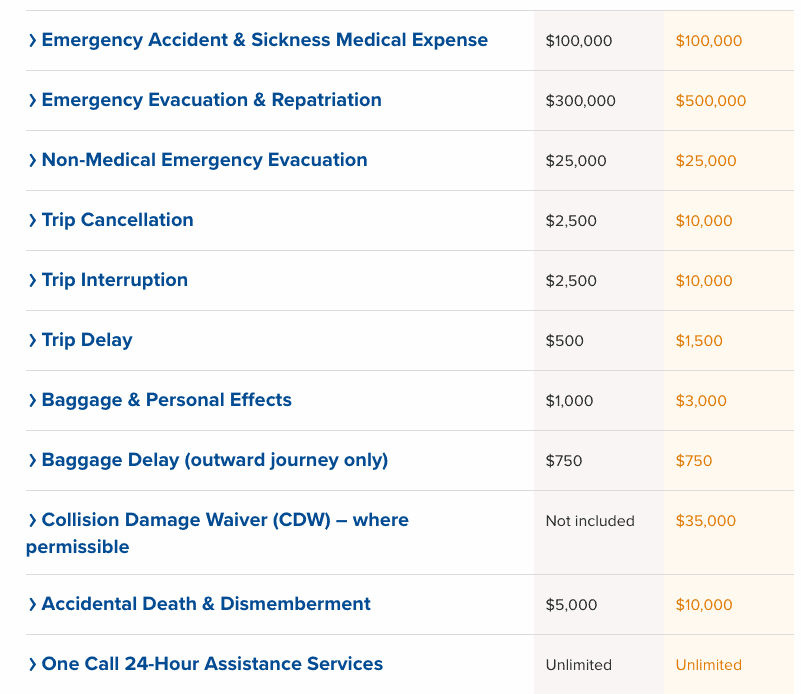

Included on this World Nomads journey insurance coverage evaluation is a breakdown of your plan choices. If you enroll, you’ll have two plans to select from:

- The Normal Plan – Greatest Possibility for Vacationers on a Price range

- The Explorer Plan – Greatest Possibility for Vacationers Searching for the Highest Protection

Whereas each plans cowl the necessities, the Explorer Plan affords a barely increased protection restrict, in addition to a number of further add-ons.

Normal Plan

The Normal Plan offers first rate medical and journey protection for the typical traveler. You’ll get $100,000 emergency accident and medical protection, which I discover is fairly beneficiant for a primary insurance coverage coverage.

If it’s important to cancel or interrupt your journey, then you definately’ll obtain as much as $2,500 in reimbursement. And in case your journey is delayed, say because of unhealthy climate, then you definately’ll get $500 again with journey delay protection.

Now, the Normal Plan comes with $1,000 in misplaced, theft or broken baggage safety. Nevertheless, you’ll solely obtain a most of $500 per merchandise (as much as a complete of $1,000). So, in the event you’re touring with costly tools or gear, remember that the per article restrict won’t cowl the whole price.

With regards to journey, the Normal Plan consists of safety for over 200 varieties of sports activities and actions. You must verify World Nomad’s listing of journey sports activities to see in case your exercise is roofed.

Explorer Plan

Whereas the Explorer Plan is costlier, it’s additionally extra complete in comparison with the Normal Plan.

The $100,000 emergency accident and medical protection is definitely equivalent to the Normal Plan. Nevertheless, emergency evacuation and repatriation will increase from $300,000 to $500,000. Should you plan on touring to distant nations with less-than-adequate medical amenities, this would possibly make investing within the Explorer Plan worthwhile.

The Explorer Plan additionally consists of increased journey cancellation and journey interruption protection. In comparison with the Normal Plan, World Nomads will reimburse you as much as $8,000 extra for any unused journey prices.

And in the event you’re touring with costly gear or electronics, then positively go along with or improve to the Explorer Plan. You’ll get thrice the quantity of coverage protection for luggage and private objects.

For journey lovers, the Explorer Plan consists of each exercise on the Normal Plan, plus extra. Whether or not you’re driving a snowboard or a mechanical bull, the Explorer Plan has you coated.

Plus, the Explorer Plan has one other further profit that’s not included with the Normal Plan. That’s the Collision Harm Waiver. That implies that, in the event you hire a automotive in another country and get into an accident, World Nomads will cowl as much as $35,000 in harm charges.

World Nomads Journey Insurance coverage Value

The worth of your journey insurance coverage will rely upon a wide range of components: your plan kind, journey size, vacation spot, your age and and your nationality.

As a part of this World Nomads journey insurance coverage evaluation, let’s take a look at some eventualities to get a way of how a lot a coverage will price you.

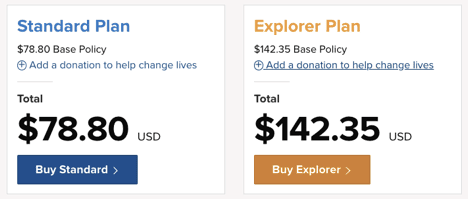

For the primary instance, let’s say you’re a United States citizen spending two weeks backpacking via Germany, Austria and Italy.

As you may see, the associated fee to insure your Eurotrip is $5.62 per day with the Normal Plan and $10.16 per day with the Explorer Plan.

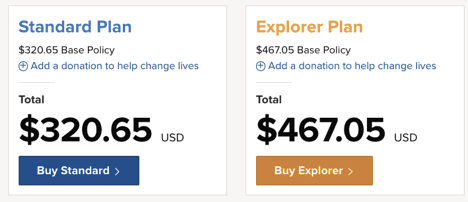

On this subsequent instance, you’re a United States citizen touring to one of the vital fashionable locations on the backpacking circuit: Southeast Asia. You propose to spend three months visiting Laos, Vietnam, Thailand and Cambodia.

If you break it down, the Normal Plan works out to be $3.56 per day whereas the Explorer Plan is $5.18 per day. And there’s no worth distinction between visiting only one nation in Southeast Asia, or all 4.

So, for simply a number of {dollars} a day, you may shield your self in opposition to hundreds of {dollars} in medical payments or cancellation charges. There’s actually no excuse to not buy a coverage with World Nomads whereas touring.

What’s Not Coated by World Nomads Journey Insurance coverage?

Though journey insurance coverage can shield you in lots of situations, it does, sadly, have its limitations.

Pre-Current Medical Circumstances

World Nomads doesn’t cowl any bills associated to a pre-existing medical situation. They’ve a pre-existing situation look-back interval of 90 days which implies you may’t file a declare for any situation you had 90 days prior to buying a plan.

Medical Test-Ups

Common physician visits are additionally not coated below your coverage. This implies you may’t file a declare for a routine bodily examination or every other non-emergency associated remedy or surgical procedure.

With regards to dental work, you’re additionally not coated for cleanings, alternative fillings or different surgical procedures that aren’t thought-about pressing.

Excessive Actions

Though they cowl a wide range of actions that the majority backpackers are possible encounter, there are nonetheless some exclusions. As an example, actions like base leaping and solo mountaineering will not be coated below your journey insurance coverage coverage.

Passport Protection

In case your passport will get stolen, misplaced or broken in your journey, you’ll not get reimbursed for any bills wanted to switch it.

Though World Nomads gained’t cowl the prices, they’re nonetheless there to help. The corporate may help you report the loss with native authorities and supply any needed info wanted to search out or substitute your passport.

Reckless or Dangerous Habits

As with most journey insurance coverage corporations, you aren’t coated for incidents that happen when you’re appearing recklessly. For instance, in the event you get into a motorbike accident with out sporting a helmet, then your medical bills will in all probability not be coated.

The identical goes with incidents that occur in the event you’re on medicine or have been consuming alcohol. Should you present as much as the hospital below the affect, then you definately’re caught paying these charges out of pocket.

Be good on the market, girls and boys.

Execs and Cons of World Nomads Journey Insurance coverage

Execs

- Worldwide 24-hour Help: Emergency companies can be found 24/7, irrespective of the place you’re on the earth. The client consultant is there to advise on subsequent steps or level you in the direction of the closest hospital or authority. To not point out, the parents on the cellphone are pleasant, useful and in addition skilled.

- On-line Coverage Changes: In case your journey modifications for any purpose, you may regulate your coverage from anyplace on the earth. So if you wish to absorb the solar in Thailand for an additional few weeks, you may merely lengthen on-line.

- Intensive Exercise Checklist: In contrast to most journey insurance coverage corporations, World Nomads mechanically consists of protection for a wide range of sports activities and actions. There’s no must pay further to guard your self for various adventures.

- Simple Declare Course of: World Nomads makes submitting a declare as simple as attainable. Via their on-line declare portal, you may add your documentation and submit your declare in just some clicks.

Cons

- Lack of Flexibility: You principally solely have two plans to select from. Meaning you’re caught with the listed declare limits. You gained’t be capable of add further advantages or improve the utmost coverage protection.

- Per Article Restrict: Since you’ll solely be reimbursed as much as a most quantity per merchandise, you won’t be capable of declare the complete quantity of your belongings. Though the Explorer Plan has the next per article restrict, you’ll nonetheless be within the gap for costly tools or gear.

Private Expertise Utilizing World Nomads

A number of years again, I traveled to Xi’an China. I deliberate to show English to a whole bunch of adorably rambunctious kids. After spending time in New Zealand and Australia, I used to be wanting to spend the following six months consuming mouth-numbing meals, exploring the countryside and enjoying with cute children within the classroom.

However I quickly found that my physique had different plans.

A routine medical examination uncovered that my uncomfortable abdomen pains have been really gallstones. This was positively not my thought of an excellent begin to my journey. However since I used to be planning to remain in China, I knew I needed to go below the knife sooner moderately than later.

Nevertheless, I wasn’t bought on the concept of getting such a severe and doubtlessly harmful surgical procedure in China. I heard one too many horror tales about unhygienic operation rooms and reused medical tools for my liking.

So I made a decision to pop over to Singapore. There, the medical amenities are thought-about a number of the finest in Asia. And simply three days later, the hospital launched me comfortable, wholesome and two gallstones lighter.

Though I had an operation in the costliest metropolis on the earth, I walked away with out having to pay a cent. And that’s as a result of I had a coverage with World Nomads. They coated my total medical invoice and hospital keep which racked as much as be greater than $8,000 USD.

So, take it from me—emergencies and accidents do occur. And, whereas we will’t predict what the long run holds, we will put together for the worst.

Though I can’t advocate my less-than-pleasant expertise with gallstones, I can vouch for World Nomads. The corporate saved me lots of monetary stress—and presumably my life.

World Nomads vs. Travelex vs. Allianz Journey

By now you’ve in all probability realized that World Nomads offers wonderful protection for many vacationers. Nevertheless, you’ve in all probability additionally already seen another names pop up throughout your search.

In an effort to enable you to weigh your choices, as a part of this World Nomads journey insurance coverage evaluation, I’ll be evaluating World Nomads with two different fashionable corporations: Travelex and Allianz.

World Nomads vs. Travelex

Travelex is one other firm primarily based out of Australia. It’s a stable identify within the journey insurance coverage business they usually provide aggressive advantages and costs.

However Travelex actually stands out from the gang because of its ease of customizability. For instance, you may add or cancel safety for any purpose. You too can add rental automotive protection. And you should have entry to medical upgrades for pre-existing medical circumstances.

That mentioned, World Nomads consists of adventurous actions with even their most simple coverage. In the meantime, Travelex prices for this profit. So in the event you plan to do any excessive sports activities in your journey, you’ll must take this further worth into consideration.

Need extra in-depth details about Travelex insurance coverage? Learn my full Travelex evaluation!

World Nomads vs. Allianz Journey

Allianz Journey is among the greatest names within the insurance coverage biz. As a result of it’s the world’s largest journey insurance coverage firm, it could possibly provide low and infrequently unbeatable costs on a lot of their plans.

However whereas the value of the OneTrip Primary is perhaps interesting, it lacks a number of the needed options that needs to be included in an excellent journey insurance coverage plan. Medical protection caps at $10,000 and medical evacuation solely covers $50,000, which is much too low, in my view.

Nevertheless, the corporate does have 4 completely different plans to select from, which implies there’s extra flexibility on the subject of pricing and advantages. And on the plus aspect, Allianz covers pre-existing medical circumstances for every plan.

Need extra in-depth details about Allianz insurance coverage? Learn my full Allianz evaluation!

I in contrast the bottom tier plans out there for World Nomads, Travelex and Allianz. For this instance, let’s take a look at a one-month journey to Thailand that’s roughly valued at $2,000.

| World Nomads | Travelex | Allianz | |

|---|---|---|---|

| Plan | Normal Plan | Journey Primary | OneTrip Primary |

| Value | $116 | $56 | $73 |

| Emergency Medical | $100,000 | $15,000 | $10,000 |

| Emergency Evacuation | $300,000 | $100,000 | $50,000 |

| Journey Cancellation | $2,500 | $2,000 | $2,000 |

| Journey Interruption | $2,500 | $3,000 | $2,000 |

| Baggage and Private Belongings | $1,000 | $500 | $500 |

For the value, World Nomads has the next than common protection restrict in comparison with Travelex and Allianz. Even the most cost effective World Nomad’s plan comes with $100,000 of emergency medical and $300,000 evacuation.

That mentioned, whereas I stand by my suggestion of utilizing World Nomads for journey insurance coverage, you would possibly discover that a number of the different corporations listed above higher suit your wants and price range.

Learn how to Make a Declare with World Nomads

Hopefully, you’ll by no means run into any surprising incidents in your journey. However in the event you do, then you definately’ll need to know the best way to make a declare with a purpose to get reimbursed.

Doc the Incident or Accident

To ensure that World Nomads to reimburse you on your declare, you’ll first want to assemble all the required proof to submit. And keep in mind, it’s your duty for following up with the precise authorities for the paperwork.

If somebody steals your pockets, then you definately’ll want the filed police report. Should you went to the hospital, then ask for the physician’s paperwork. The extra documentation you’ve, the extra possible it’s your declare might be accepted by World Nomads.

Make a Declare Via Your World Nomads Dashboard

The method to make a declare on-line is pretty simple. All it’s important to do is log into the web site and reply a sequence of questions concerning the incident and fasten any supporting documentation. That’s it!

Afterwards, your declare goes to World Nomads to evaluation and course of. If they’ve additional questions or want extra info, then they’ll contact you through e mail or phone.

It might take a number of days to for them to evaluation your declare, however as soon as World Nomads approves your declare, you must obtain your a reimbursement in 5 or so enterprise days.

Ultimate Ideas

There are so many alternative journey insurance coverage corporations within the business right now. With dozens of opponents, plans and advantages to select from, discovering the perfect one could seem daunting. However after studying this World Nomads Journey Insurance coverage evaluation, I hope you are feeling extra knowledgeable about what to search for and the best way to choose a coverage.

Whether or not you’re planning a brief weekend getaway or a multi-country world tour, World Nomads affords fairly sturdy protection.

So what are you ready for? Now that you simply’ve learn this World Nomads evaluation, simply click on the button under to get your free quote and resolve if it’s best for you.

![World Nomads Travel Insurance Review [HONEST 2023 Update]](https://leslynewsmagazine.online/wp-content/uploads/2019/05/world-nomads-travel-insurance-review.jpg)